43 ytm for zero coupon bond

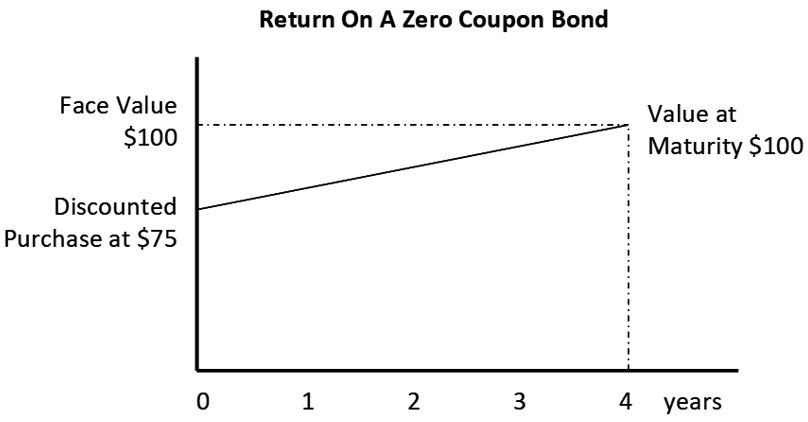

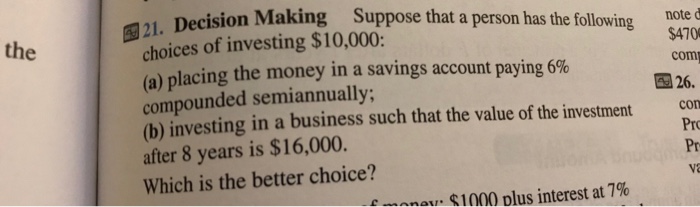

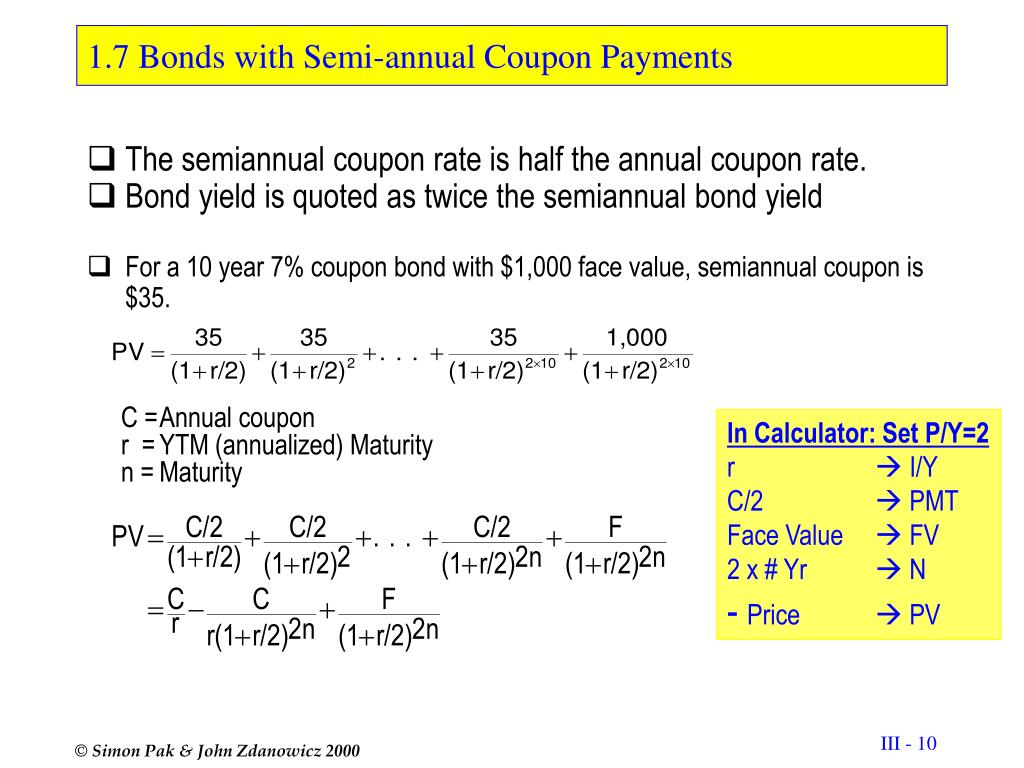

Yield to Maturity Calculator (YTM Calculator) - YTM Formula C = Bond Coupon Rate F = Bond Par Value P = Current Bond Price n = Years to Maturity. How to Calculate Yield to Maturity . To apply the yield to maturity formula, we need to define the face value, bond price and years to maturity. For example, if you purchased a $1,000 for $900. The interest is 8 percent, and it will mature in 12 years, we will plugin the variables. C = … Zero Coupon Bond Value Calculator: Calculate Price, Yield ... YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity ; Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages …

Bond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

Ytm for zero coupon bond

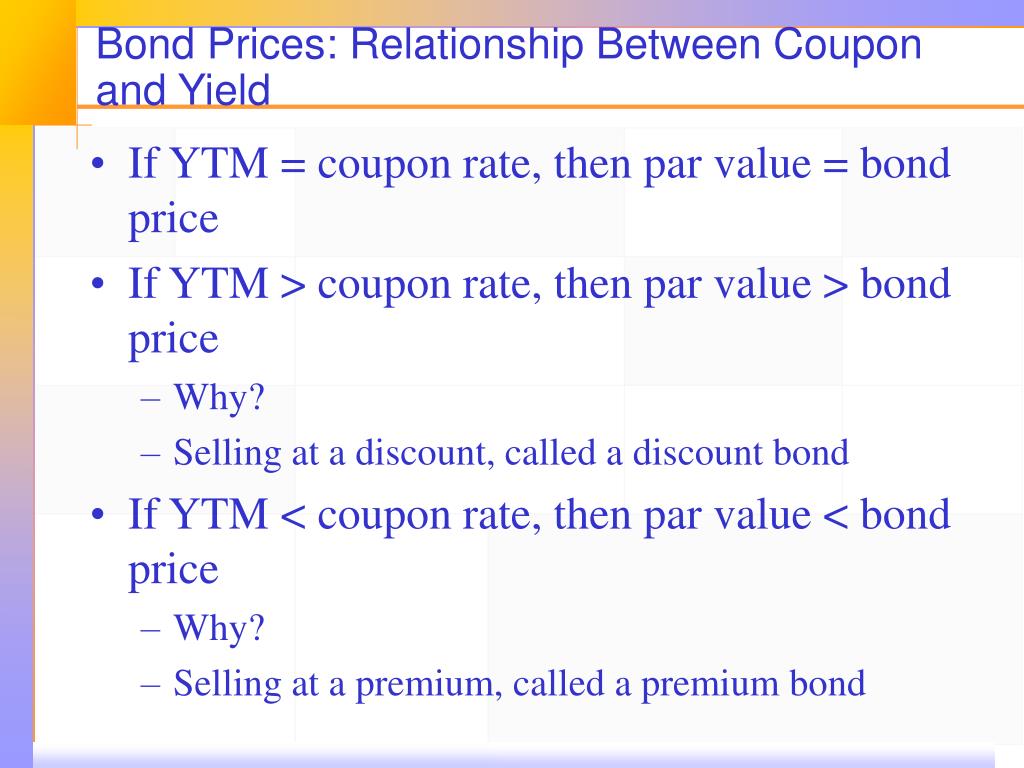

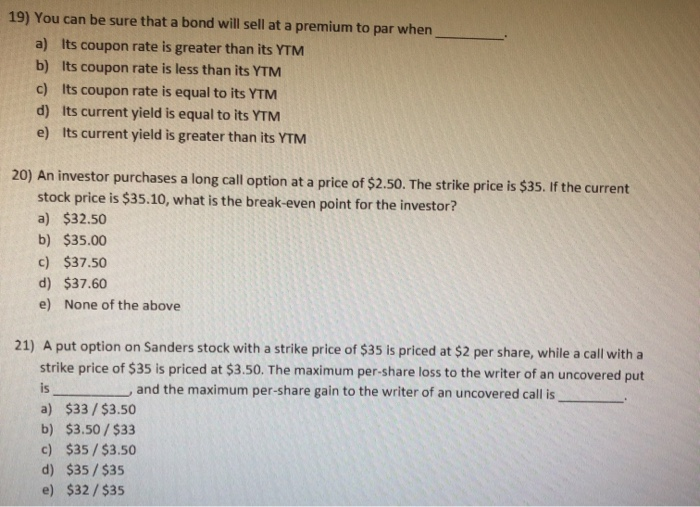

VALUATION (BONDS AND STOCK) - University of South Florida ♦ Zero coupon bonds—the coupon rate of interest is zero, so no interest is paid; the market prices of these bonds are discounted below the maturity value ♦ Junk bonds—high-risk, high-yield bonds • Bond Contract Features o Bond Indenture—the bond contract that specifies maturity date, principal amount, coupon interest, and other features of the bond o Call Provision—a …

Ytm for zero coupon bond. VALUATION (BONDS AND STOCK) - University of South Florida ♦ Zero coupon bonds—the coupon rate of interest is zero, so no interest is paid; the market prices of these bonds are discounted below the maturity value ♦ Junk bonds—high-risk, high-yield bonds • Bond Contract Features o Bond Indenture—the bond contract that specifies maturity date, principal amount, coupon interest, and other features of the bond o Call Provision—a …

Post a Comment for "43 ytm for zero coupon bond"