41 zero coupon bonds duration

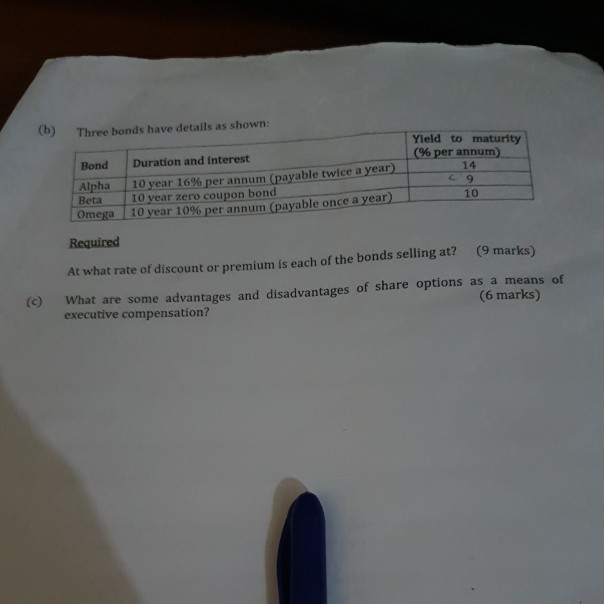

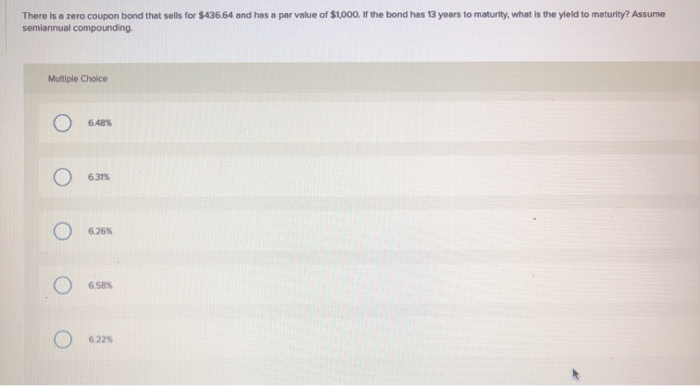

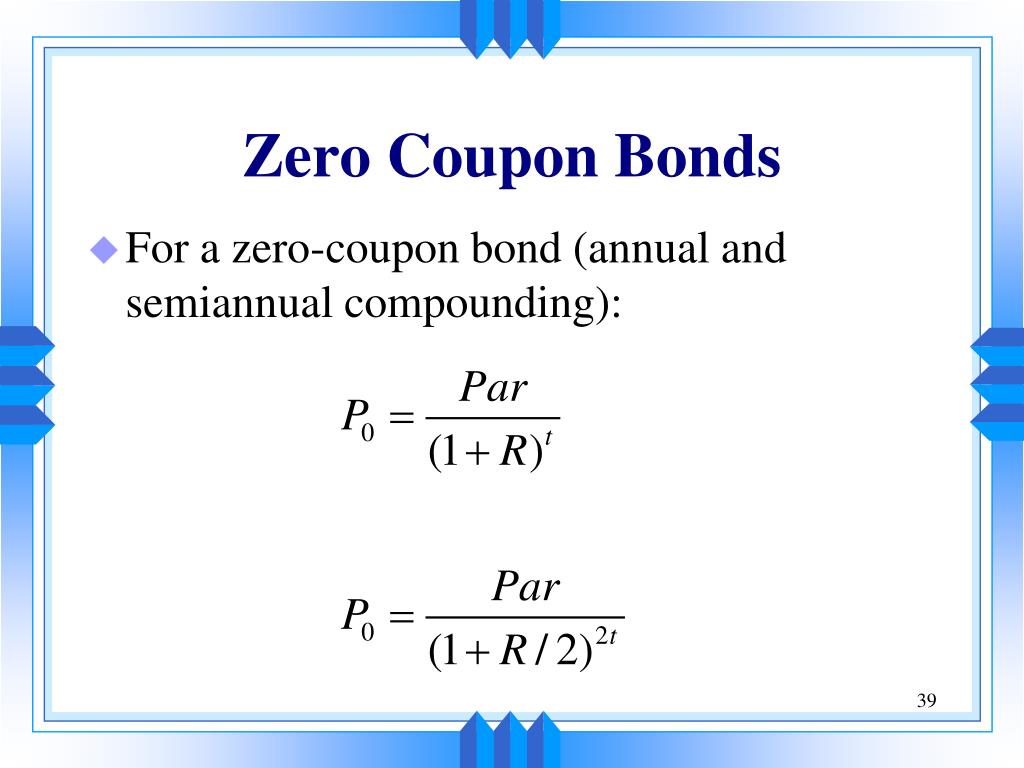

› zero-coupon-bondZero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. › terms › dDuration Definition - Investopedia May 31, 2022 · Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond ...

How to Calculate Dollar Duration (DV01)? - WallStreetMojo Dollar Duration or DV01 can also be calculated if one is aware of the Bonds Duration, ... Zero Coupon Bonds Zero Coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to its par value and does not pay periodic interest.

Zero coupon bonds duration

Zero coupon, zero principal bond declared securities 17.7.2022 · The Finance Ministry has declared zero coupon zero principal instruments (ZCZP) as securities. Experts say this will help many organisations including corporates to utilise their fund marked for ... United Kingdom Government Bonds - Yields Curve 25.8.2022 · The United Kingdom 10Y Government Bond has a 2.623% yield.. 10 Years vs 2 Years bond spread is -17.4 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.75% (last modification in August 2022).. The United Kingdom credit rating is AA, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is … The One-Minute Guide to Zero Coupon Bonds | FINRA.org Like virtually all bonds, zero-coupon bonds are subject to interest-rate risk if you sell before maturity. If interest rates rise, the value of your zero-coupon bond on the secondary market will likely fall. Long-term zeros can be particularly sensitive to changes in interest rates, exposing them to what is known as duration risk.

Zero coupon bonds duration. Zero Coupon Bond (Definition, Formula, Examples, Calculations) Basis Zero-Coupon Bond Regular Coupon Bearing Bond; Meaning: It refers to fixed Income Fixed Income Fixed Income refers to those investments that pay fixed interests and dividends to the investors until maturity. Government and corporate bonds are examples of fixed income investments. read more security, which is sold at a discount to its Par value and doesn’t involve … › news › businessMC Explains | What is a 'zero-coupon, zero-principal' instrument? Jul 20, 2022 · The government has cleared 'zero-coupon, zero-principal' instruments for listing as securities on the social stock exchanges. ... it will come with a time duration. “These bonds will carry a ... › economy › policyZero coupon, zero principal bond declared securities - The ... Jul 17, 2022 · The Finance Ministry has declared zero coupon zero principal instruments (ZCZP) as securities. ... As on date, this list included shares, scrips, stocks, bonds, debentures, debenture stock or ... › investors › insightsThe One-Minute Guide to Zero Coupon Bonds | FINRA.org Like virtually all bonds, zero-coupon bonds are subject to interest-rate risk if you sell before maturity. If interest rates rise, the value of your zero-coupon bond on the secondary market will likely fall. Long-term zeros can be particularly sensitive to changes in interest rates, exposing them to what is known as duration risk. Also, zeros ...

The Basics Of Bonds - Investopedia 31.7.2022 · Duration can be calculated on a single bond or for an entire portfolio of bonds. Bonds and Taxes Because bonds pay a steady interest stream, called the coupon, owners of bonds have to pay regular ... › articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon U.S. Treasury bonds have a poor risk-return profile when held alone. Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run ... Advantages and Risks of Zero Coupon Treasury Bonds 31.1.2022 · Zero coupon bonds are bonds that do not make any interest payments until maturity, you won't put a single penny of interest in your pocket for two decades. MC Explains | What is a 'zero-coupon, zero-principal' instrument? 20.7.2022 · The government has cleared 'zero-coupon, zero-principal' instruments for listing as securities ... it will come with a time duration. “These bonds will …

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the S&P 500 with dividends reinvested by 500% over the subsequent 30-years as interest rates fell from around 14.6% to around 3%. I started investing in 30 Year zero coupon treasuries. Now, zero coupon bonds don't pay any interest ... Bonds & Rates - WSJ Bonds & Rates News. Junk-Bond Rally Trips Over Rate-Hike Fears. Shrinking Deficits Cushion Fed’s Retreat From Markets. Bed Bath & Beyond’s Fizzling Rally Narrows Options for … Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Longer duration bonds are more sensitive to shifts in interest rates. And zero-coupon long duration bonds are more sensitive to rate shifts than bonds which regularly pay interest. Typically the yield curve is upward sloping with longer duration bonds offering a higher return to compensate for the added risk. The One-Minute Guide to Zero Coupon Bonds | FINRA.org Like virtually all bonds, zero-coupon bonds are subject to interest-rate risk if you sell before maturity. If interest rates rise, the value of your zero-coupon bond on the secondary market will likely fall. Long-term zeros can be particularly sensitive to changes in interest rates, exposing them to what is known as duration risk.

United Kingdom Government Bonds - Yields Curve 25.8.2022 · The United Kingdom 10Y Government Bond has a 2.623% yield.. 10 Years vs 2 Years bond spread is -17.4 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.75% (last modification in August 2022).. The United Kingdom credit rating is AA, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is …

Zero coupon, zero principal bond declared securities 17.7.2022 · The Finance Ministry has declared zero coupon zero principal instruments (ZCZP) as securities. Experts say this will help many organisations including corporates to utilise their fund marked for ...

Post a Comment for "41 zero coupon bonds duration"