45 coupon rate vs ytm

Coupon Rate Definition - Investopedia The yield to maturity is when a bond is purchased on the secondary market, and it's the difference in the bond's interest payments, which may be higher or lower ... Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. · The coupon rate is ...

Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a ...

Coupon rate vs ytm

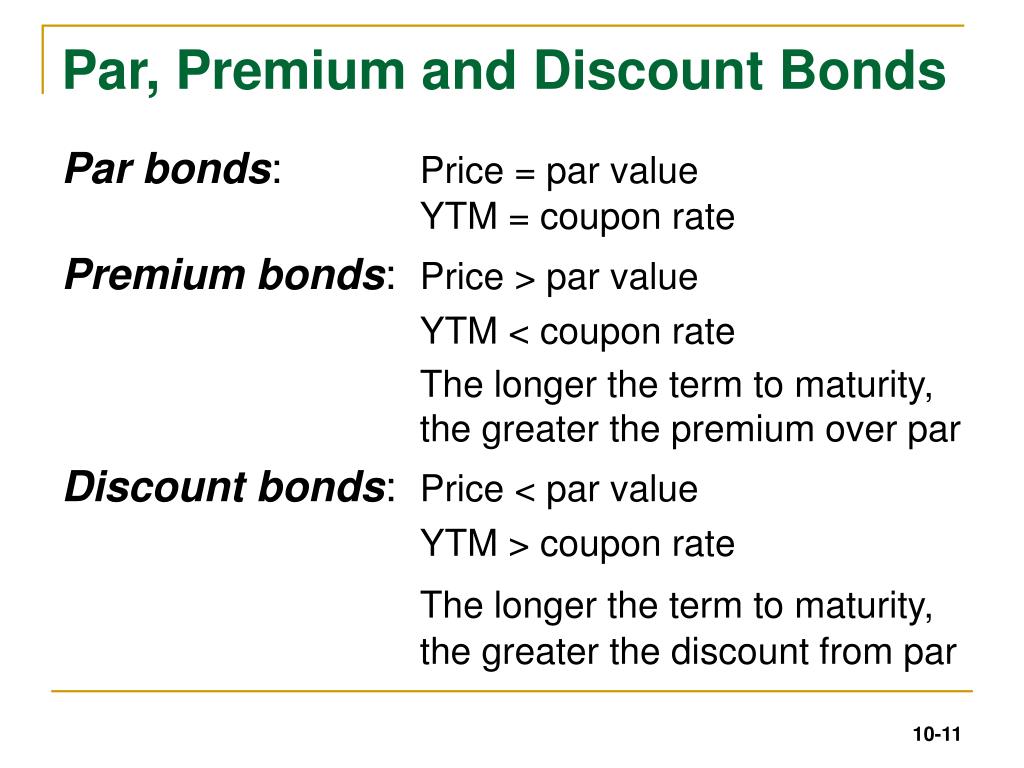

When a Bond's Coupon Rate Is Equal to Yield to Maturity A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, ... Difference between Coupon Rate And Yield To Maturity Another difference between these two metrics is that the YTM represents the average rate of return that an investor is likely to experience over the bond's ... The Difference Between Coupon and Yield to Maturity In short, "coupon" tells you what the bond paid when it was issued. The yield—or “yield to maturity”—tells you how much you will be paid in the future. Here's ...

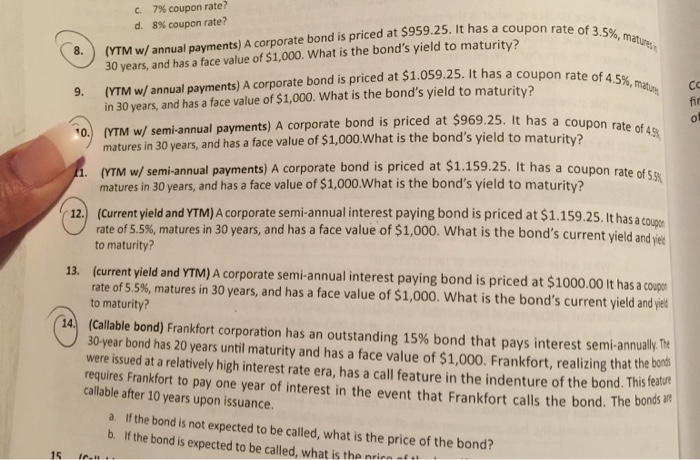

Coupon rate vs ytm. Difference Between YTM and Coupon rates 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per ... Yield to Maturity (YTM) - Investopedia Example: Trial and Error — The bond is currently priced at a discount of $95.92, matures in 30 months, and pays a semi-annual coupon of 5%. The Difference Between Coupon and Yield to Maturity In short, "coupon" tells you what the bond paid when it was issued. The yield—or “yield to maturity”—tells you how much you will be paid in the future. Here's ... Difference between Coupon Rate And Yield To Maturity Another difference between these two metrics is that the YTM represents the average rate of return that an investor is likely to experience over the bond's ...

When a Bond's Coupon Rate Is Equal to Yield to Maturity A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, ...

Post a Comment for "45 coupon rate vs ytm"