38 difference between coupon rate and market rate

Difference between Yield and Interest Rate Yield is always higher than an interest. Interest is always lower than yield. Expression. Yield can be expressed as percentage and as amounts of currency as well. Interest rates are largely expressed in terms of percentage. Overlapping. Yield always includes the amount of interest gained. Difference Between Coupon Rate and Interest Rate Coupon rate of a fixed term security such as bond is the amount of yield paid annually that expresses as a percentage of the par value of the bond. In contrast, interest rate is the percentage rate that is charged by the lender of money or any other asset that has a financial value from the borrower.

Difference Between Discount Rate and Interest Rate • Discount rates may refer to two different things; the interest that is charged by the central bank from banks and financial institutions that borrow overnight loans and the interest rates that are used in discounting cash flows. • Interest rates are determined by the forces of demand and supply and are regulated by the central bank.

Difference between coupon rate and market rate

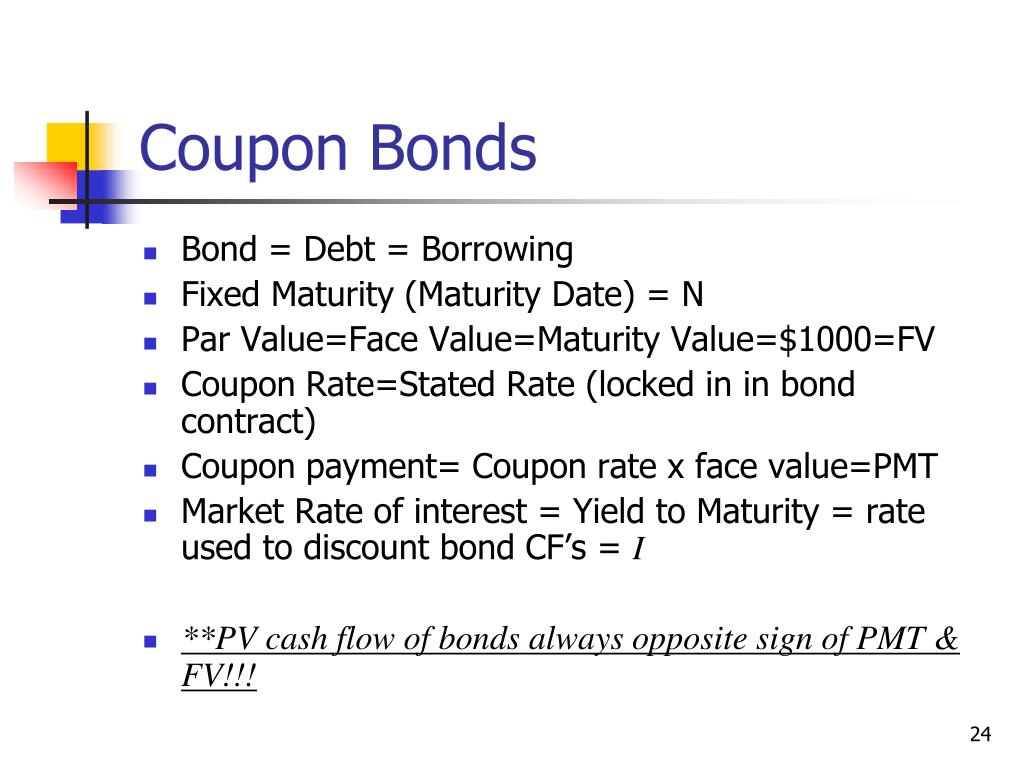

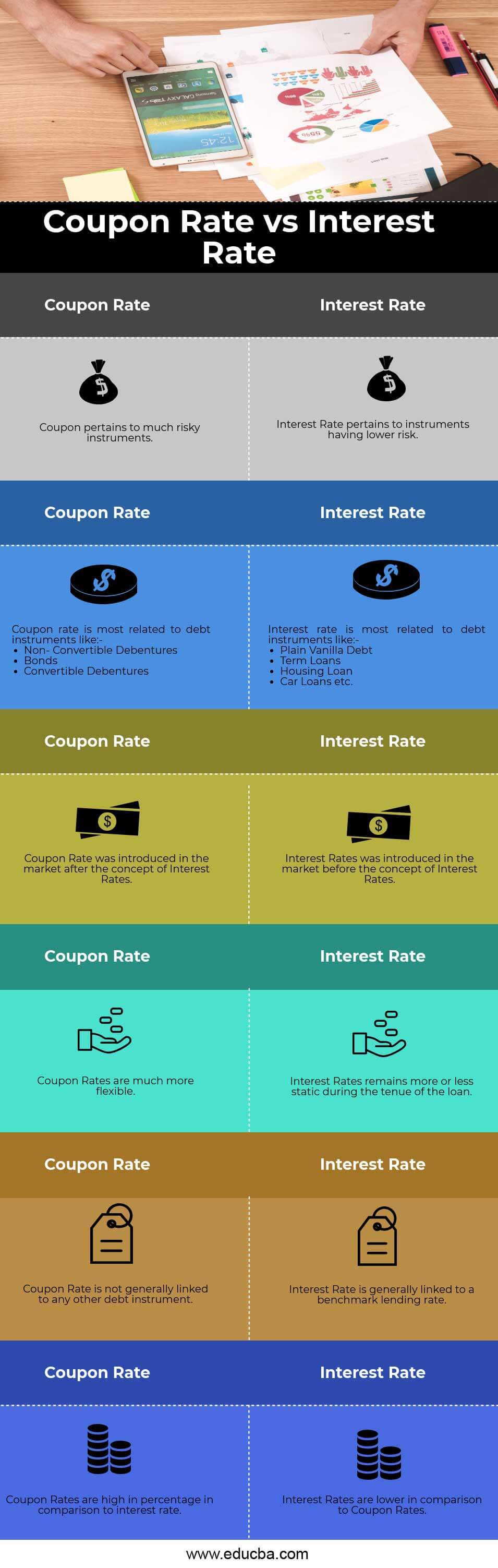

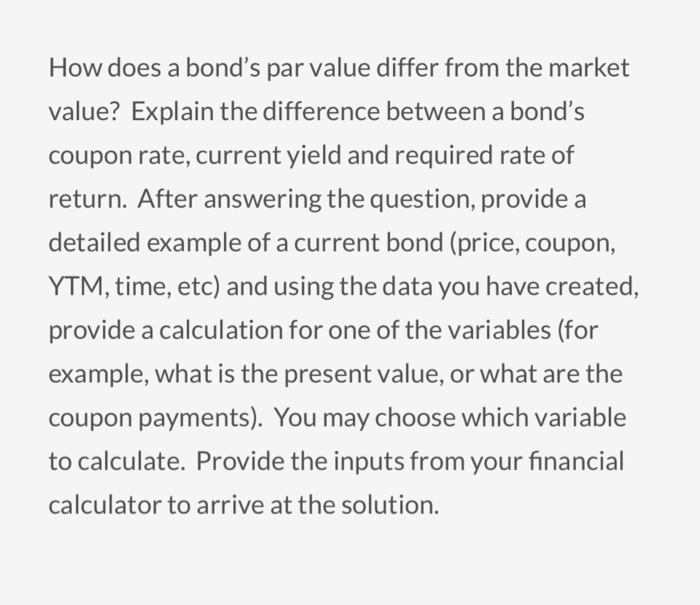

Bond Stated Interest Rate Vs. Market Rate | Pocketsense Because of the manner in which bonds are traded, the coupon rate often differs from the market interest rate. Tips A coupon rate is a fixed rate of return attached to the face value of the bond paid to the purchaser from the seller, while the market interest rate can change dramatically throughout the lifespan of the bond. Bond Basics Difference Between YTM and Coupon rates YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author Recent Posts Ian Search DifferenceBetween.net : 9 Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) The coupon rate is decided by the issuer of the bonds to the purchaser. The interest rate is decided by the lender. Coupon rates are largely affected by the interest rates decided by the government. If the interest rates are set to 6%, then no investor will accept the bonds offering coupon rate lower than this.

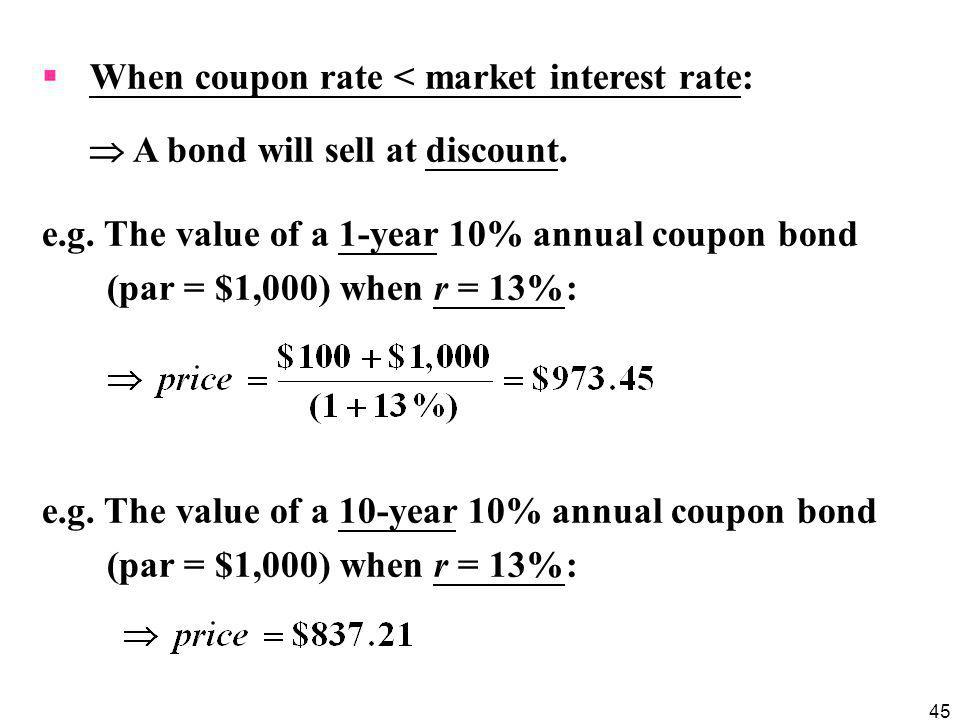

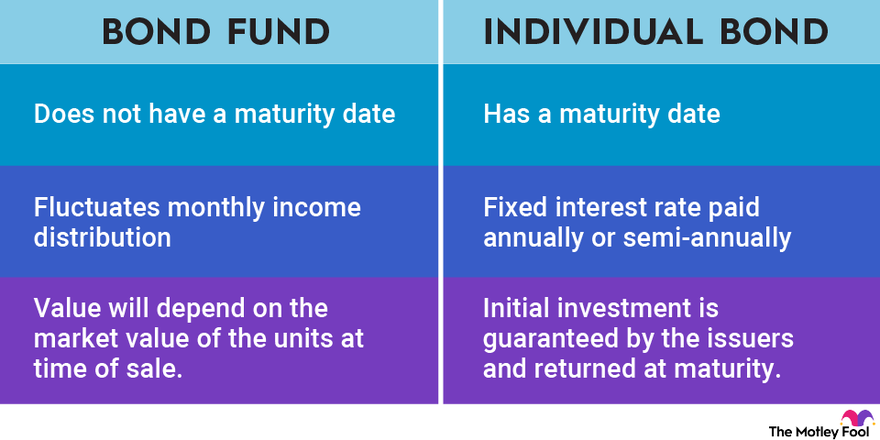

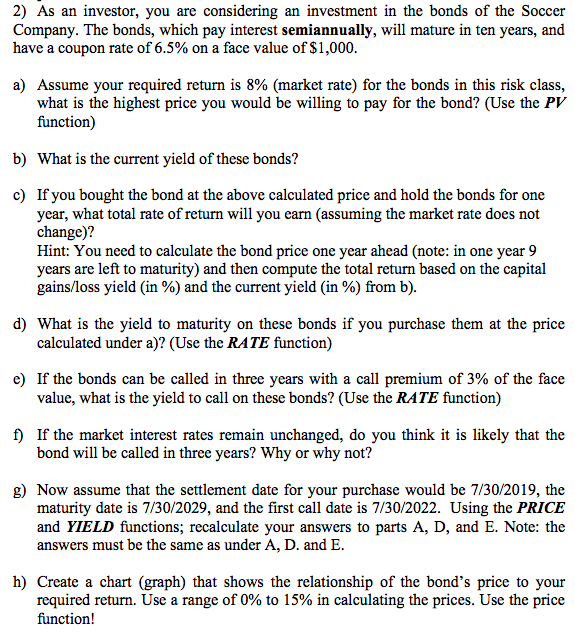

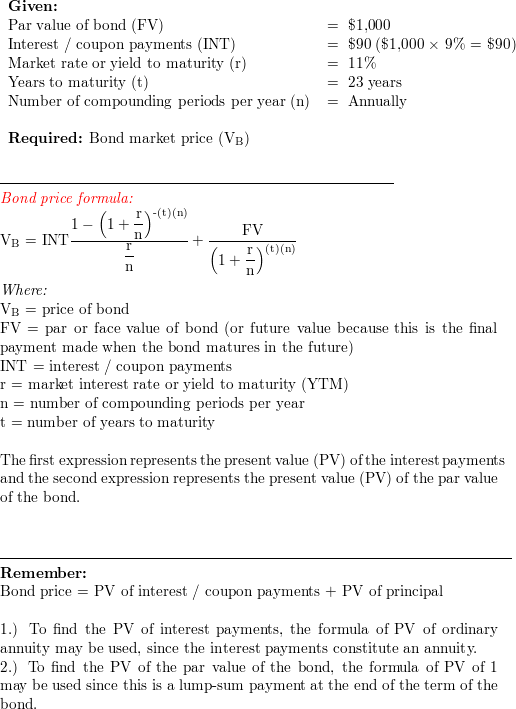

Difference between coupon rate and market rate. What is the difference between coupons and dividends? In fact, if the coupons are not paid on time by the borrower it can take the default procedure, bankruptcy. There are fixed rate coupons and floating rate coupons. There are also zero coupon bonds in which the yield to maturity of the bond is cashed by calculating the difference between the subscription price and the redemption price. Business Finance - Interest Rates and Bond Valuation A. YTM is another term for the bond's coupon rate. B. YTM is the yield that will be earned if the bond is sold immediately in the market. C. YTM is the prevailing market interest rate for bonds with similar features. D. YTM is the expected return for an investor who buys the bond today and holds it to maturity. C & D Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%. However,... Difference Between Coupon Rate and Required Return The coupon rate does is independent of the market value. The required return is dependent on the dividend value. The coupon rate is directly dependent on the bond price, whereas the required return is directly dependent on the risk involved. Coupon Rate has a risk on investment due to the fluctuations of the coupon rate.

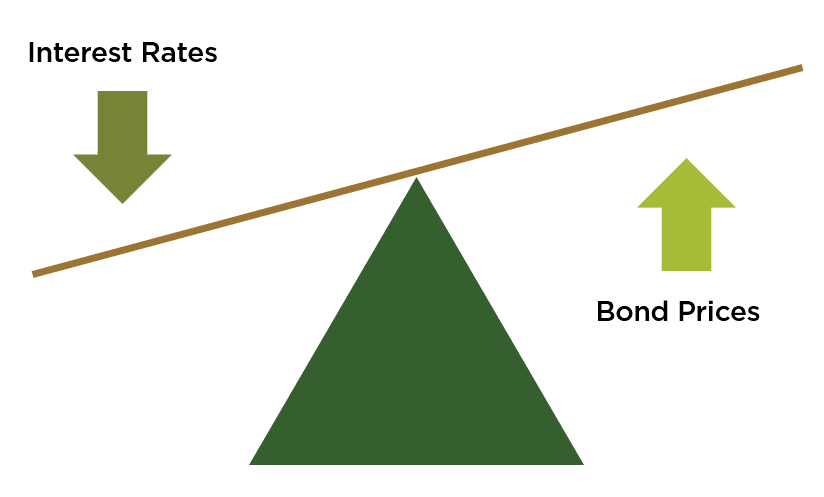

Important Differences Between Coupon and Yield to Maturity - The Balance Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%). What is the difference between the coupon rate and market rate? What is the difference between the coupon rate and market rate? A. NSWER . Paper Title: What is the difference between the coupon rate and market rate? No. of Words: 539 : PRICE: $5.00: User Ratings: Pages: 2.156: Submitted by: professor valin Finance. Student Name ... Coupon vs Yield | Top 8 Useful Differences (with Infographics) - EDUCBA 3. Interest rates influence the coupon rates. The current yield compares the coupon rate to the market price of the bond. 4. The coupon amount remains the same until maturity. Market price keeps on fluctuating, better to buy a bond at a discount which represents a larger share of the purchase price. 5. Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... - EDUCBA The key difference between coupon rate vs interest rate is that interest rate is generally and in most of the cases are related to plain vanilla debt like term loans and other kinds of debt which are availed by companies and individuals for various business requirements.

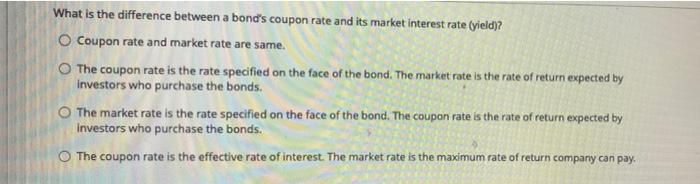

Solved What is the difference between a bond's coupon rate | Chegg.com The market rate is the rate of return expected by investors who purchase the bonds. The market rate is the rate specified on the face of the bond. The coupon rate is; Question: What is the difference between a bond's coupon rate and its market interest rate (yield)? O Coupon rate and market rate are same. The coupon rate is the rate specified ... Difference Between Yield & Coupon Rate 1.Yield rate and coupon rate are financial terms commonly used when purchasing and managing bonds. 2.Yield rate is the interest earned by the buyer on the bond purchased, and is expressed as a percentage of the total investment. Coupon rate is the amount of interest derived every year, expressed as a percentage of the bond's face value. What's the difference between the cost of debt and a coupon rate? The coupon rate is the rate the bond at 100% face of value the bond, usually $10,000. But as interest rates change in the marketplace, the real value and interest rate of the bond will change. Let's say a 20-year bond comes out at 3.0%. And then Fed raises its funds rate, 50 basis points or 0.5%. That would push up all interest rates. What is 'Coupon Rate' - The Economic Times Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ...

What is the difference between coupon rate and market - Course Hero The market can also give a premium rate that is greater, than a discount rate. The reason its called a coupon rate is that before electronic investing each bond that was issued is made of paper called coupons. These were issued to redeem for money.

Discount Rate vs Required Rate of Return - Financial Analyst Insider Acorn is offering a $5 Referral bonus for new signups.; Using the Required Rate of Return to Calculate Market Implied Discount Rate for a Stock. Now that we have an estimate for the required rate of return for US equities, we can use this to calculate the discount rate implied by the current stock price assuming we are calculating the discount rate for a dividend paying stock.

Finance exam 2 Flashcards | Quizlet It is also the expected return for an investor who buys the bond and holds it to maturity. The coupon rate determines the periodic interest payments made to investors. YTM is the expected return for an investor who buys the bond today and holds it to maturity. YTM is the prevailing market interest rate for bonds with similar features.

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia It is the sum of all of its remaining coupon payments. A bond's yield to maturity rises or falls depending on its market value and how many payments remain to be made. The coupon rate is the annual...

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo Key Differences For the calculation of the coupon rate, the denominator is the face value of the bond, and for the calculation of the yield of a bond, the denominator is the market price of the bond.

Difference Between Cap Rate and Discount Rate - PropertyMetrics The cap rate allows us to value a property based on a single year's NOI. So, if a property had an NOI of $80,000 and we thought it should trade at an 8% cap rate, then we could estimate its value at $1,000,000. The discount rate, on the other hand, is the investor's required rate of return. The discount rate is used to discount future cash ...

Answered: What is the difference between the… | bartleby Q: What is the difference between the coupon rate and the current market interestrate of a bond? A: It is the yearly interest rate rewarded to the bondholders. It stated as a percentage of face value.…

Difference Between Coupon Rate and Interest Rate Main Differences Between Coupon Rate and Interest Rate Coupon rates are calculated on the fixed-income security, whereas interest rates are calculated on the amount which has been lent to borrowers. The coupon's face value determines the nominal value of the bond. Albeit the Interest rate's face value affected by the amount due on.

The Difference between a Coupon and Market Rate - BrainMass Coupon rate is the interest rate to be paid on the bond at regular interval. In this case coupon rate is 8%. If the face value of the bond is $1000, the holder of the bond will receive $80 at the end of every year during the duration of the bond. In addition the bond holder will receive $1000 back on the maturity of the ... Solution Summary

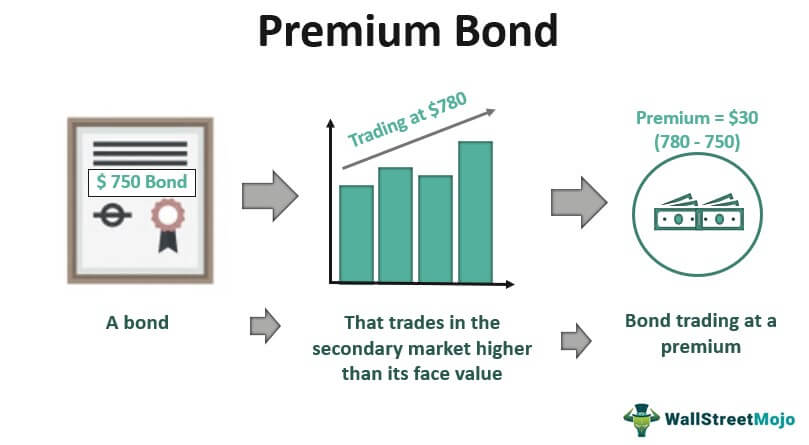

What's the Difference Between Premium Bonds and Discount Bonds? A bond will trade at a discount when it offers a coupon rate that is lower than prevailing interest rates. Since investors want a higher yield, they will pay less for a bond with a coupon rate lower than the prevailing rates—the upfront discount makes up for the lower coupon rate. What Makes Them Different?

What is difference between coupon rate and interest rate? The coupon rate is the rate the bond at 100% face of value the bond, usually $10,000. But as interest rates change in the marketplace, the real value and interest rate of the bond will change. Let's say a 20-year bond comes out at 3.0%. And then Fed raises its funds rate, 50 basis points or 0.5%. That would push up all interest rates.

Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) The coupon rate is decided by the issuer of the bonds to the purchaser. The interest rate is decided by the lender. Coupon rates are largely affected by the interest rates decided by the government. If the interest rates are set to 6%, then no investor will accept the bonds offering coupon rate lower than this.

Difference Between YTM and Coupon rates YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author Recent Posts Ian Search DifferenceBetween.net : 9

Bond Stated Interest Rate Vs. Market Rate | Pocketsense Because of the manner in which bonds are traded, the coupon rate often differs from the market interest rate. Tips A coupon rate is a fixed rate of return attached to the face value of the bond paid to the purchaser from the seller, while the market interest rate can change dramatically throughout the lifespan of the bond. Bond Basics

Post a Comment for "38 difference between coupon rate and market rate"