44 t bill coupon rate

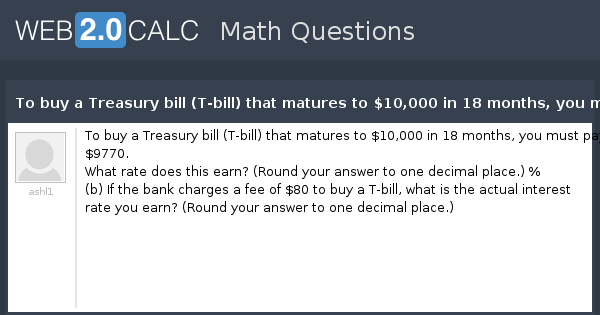

Are T-Bills "coupon equivalent" rates based in annual terms? 1 According to treasury.gov, the "coupon equivalent" for a 1 month (4 weeks) T-Bill issued today is 0.99%. I happened to have purchased a 1 month T-Bill today for $99.9246. By my calculation that means that the return will be .075% (.0754/99.9246) for the month. Your Money: How rate of return on T-Bills is calculated A bill with more than 182 days to maturity, would be compared with a bond with more than 182 days to maturity, which is not a zero coupon security. Thus, the bill must be treated as if it too pays ...

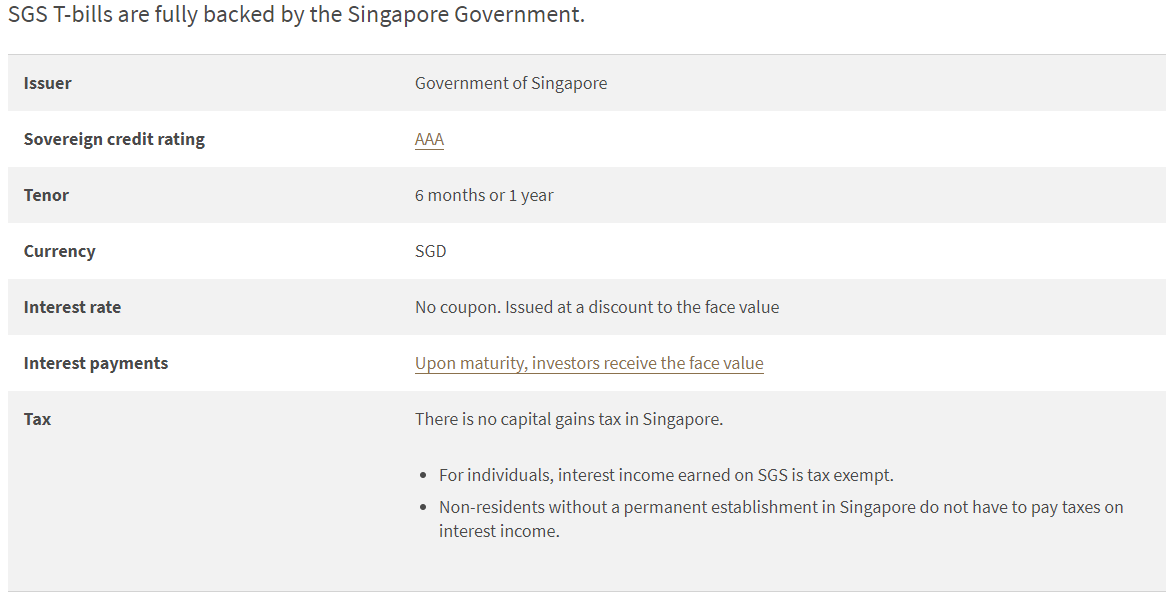

T-bills: Information for Individuals - Monetary Authority of Singapore T-bills: Information for Individuals. Treasury bills (T-bills) are short-term Singapore Government Securities (SGS) issued at a discount to their face value. Investors receive the full face value at maturity. The Government issues 6-month and 1-year T-bills.

T bill coupon rate

US T-Bill Calculator | Good Calculators Treasury Bills are normally sold in groups of $1000 with a standard period of either 4 weeks, 13 weeks, or 26 weeks. Using our US T-Bill Calculator below you are able to select the face value of your bonds using the drop down list of common values, or you may enter an alternative value that isn't listed in the "Other Value" box. 13-Week T-Bill Rate Cash (TBY00) - Barchart.com Today's 13-Week T-Bill Rate prices with latest 13-Week T-Bill Rate charts, news and 13-Week T-Bill Rate futures quotes. Treasury Bills (T-Bills) - Meaning, Examples, Calculations - WallStreetMojo While the minimum purchase is just $100, up to $5 million non-competitive T-Bills can be purchased in a single auction. Competitive ones can be purchased up to 35% of the offering amount. According to US Treasury Department, the treasury bills rates on 3 rd September 2021 were as follows:

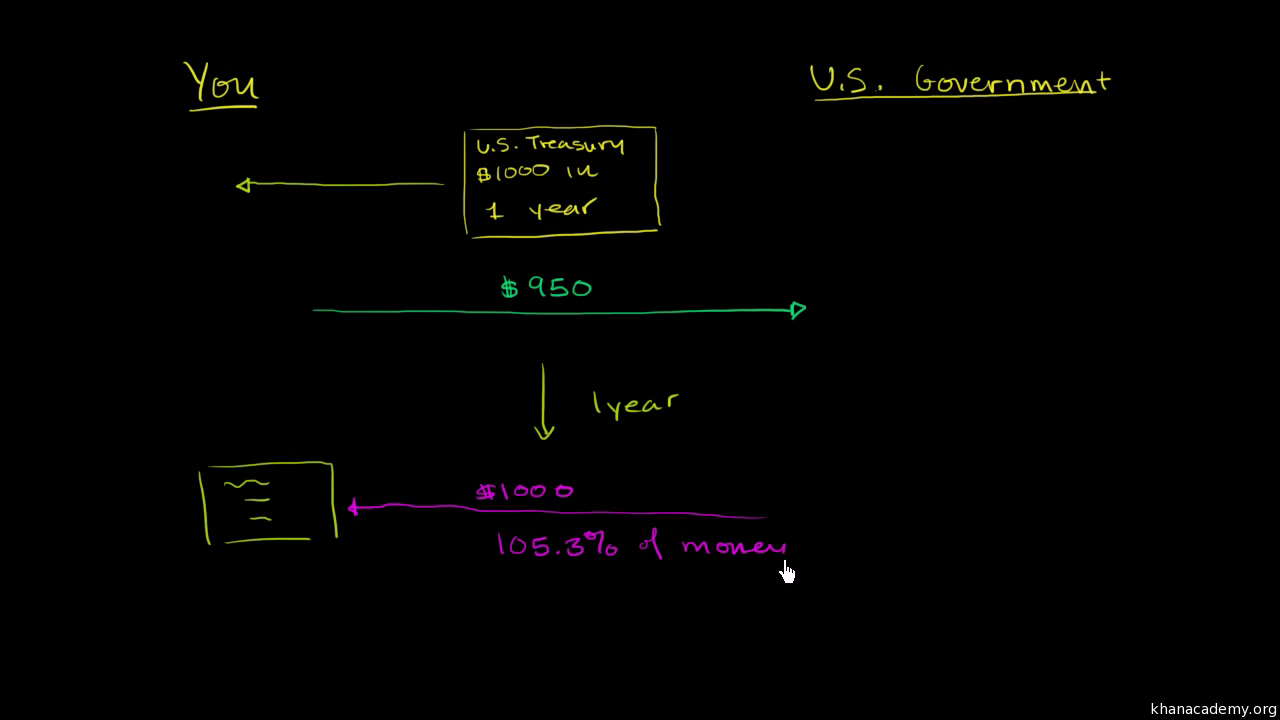

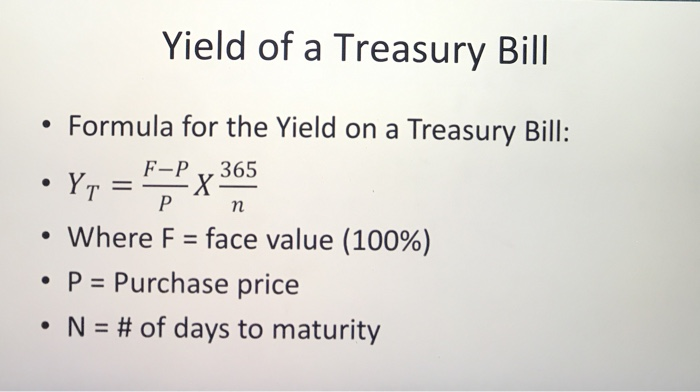

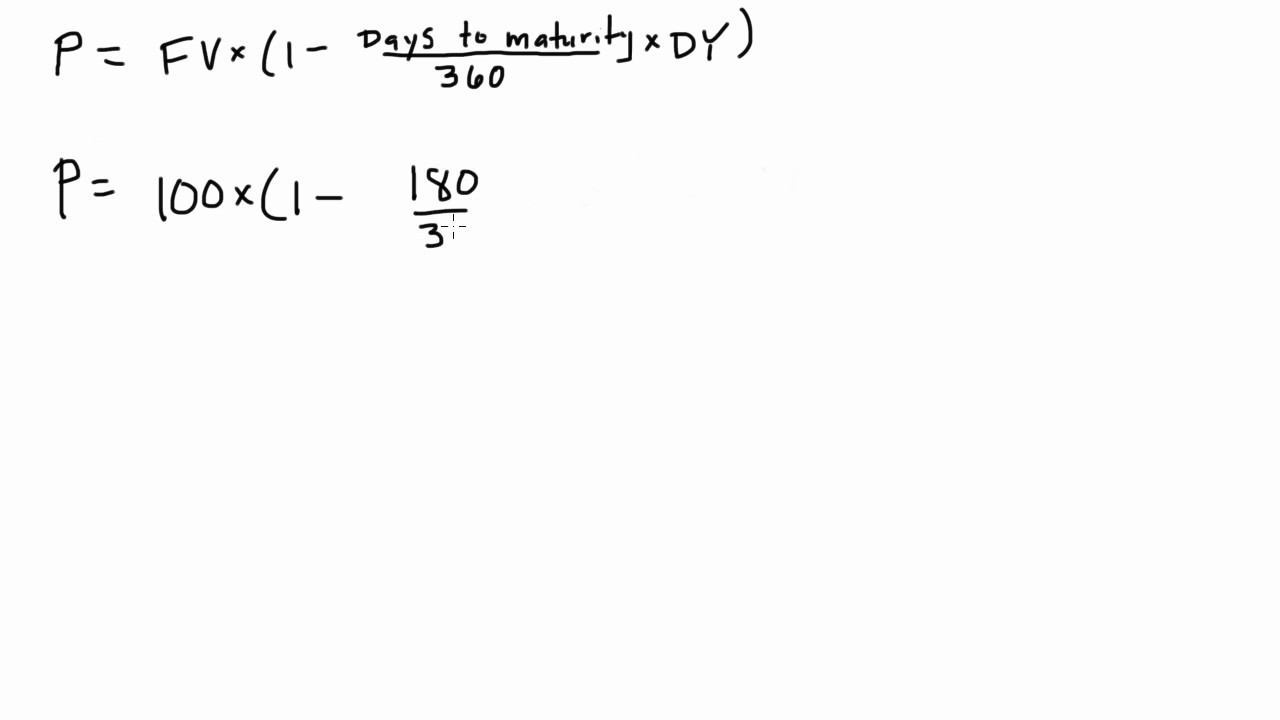

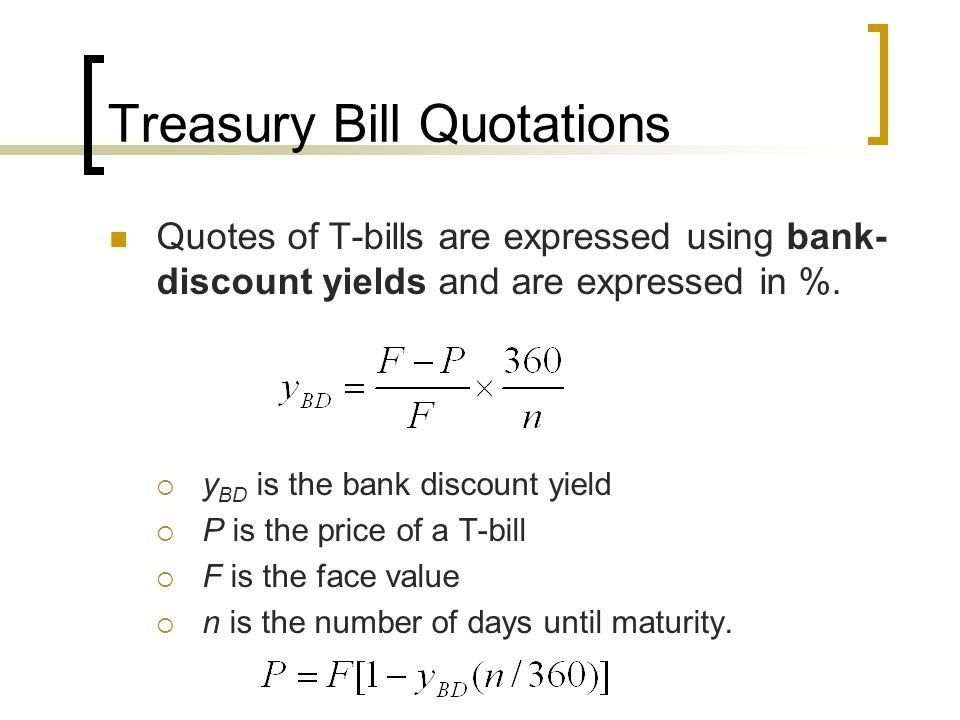

T bill coupon rate. The Basics of the T-Bill - Investopedia A Treasury Bill or T-Bill is a debt obligation issued by the U.S. Department of the Treasury. Of the debt issued by the U.S. government, the T-Bill has the shortest maturity, ranging from a few days to one year. T-Bills are typically sold at a discount to par value (also known as face value). When the bill matures, you are paid par value. The diffe... Understanding Pricing and Interest Rates — TreasuryDirect A $1,000 26-week bill sells at auction for a discount rate of 0.145%. Price = 1000 (1 - (.00145 x 180)/360) = $999.27 The formula shows that the bill sells for $999.27, giving you a discount of $0.73. When you get $1,000 after 26 weeks, you have earned $0.73 in "interest." Bonds and Notes Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to... US Treasury Bill Calculator [ T-Bill Calculator ] The annual percentage profit rate based the period of the treasury bill investment The annual interest rate of your T-Bill is calculated for information only. For example, you buy a $5000 T-Bill for $4800 over three months. Your profit is $200, the rate of return is 4.17% Calculations can be saved to a table by clicking the "Add to table" button

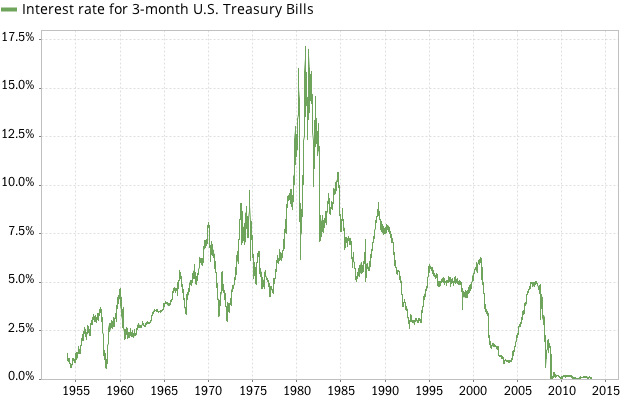

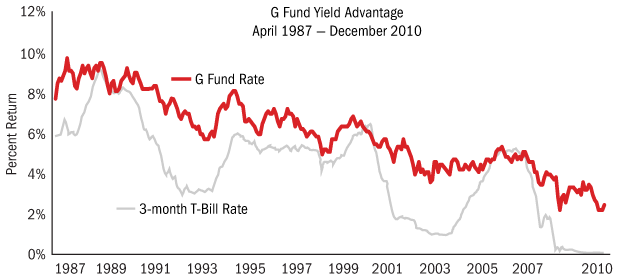

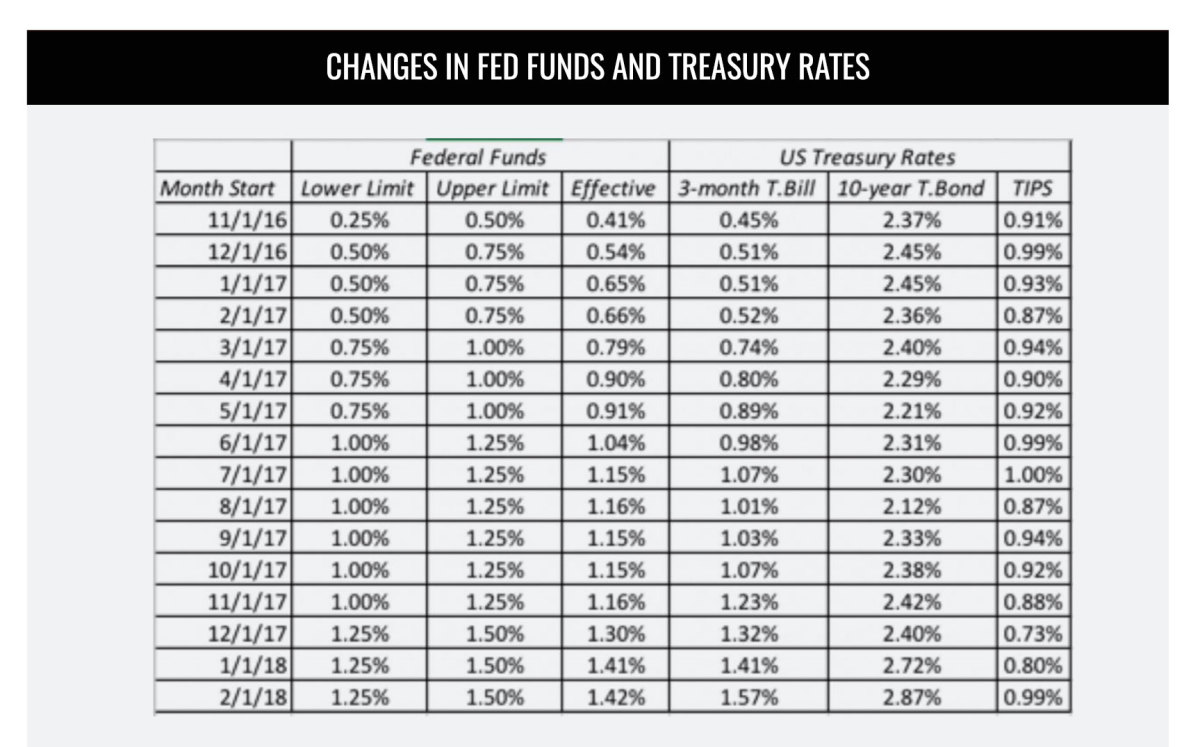

91 Day T Bill Treasury Rate - Bankrate The difference between the discounted price and the face value determines the yield. The yield on 91-day Treasury bills is the average discount rate. How it's used: The rate is used as an... How Are Treasury Bill Interest Rates Determined? - Investopedia U.S. Treasury bills (T-bills) are typically sold at a discount from their par value. The level of discount is determined during Treasury auctions. Unlike other U.S. Treasury securities such as Treasury notes (T-notes) and Treasury bonds (T-bonds), T-bills do not pay periodic interest at six-month intervals. The interest rate for Treasuries is therefore determined through a combination of the total discounted value and the maturity length. 1 Treasury Bills — TreasuryDirect Also see Understanding pricing and interest rates. Interest paid: When the bill matures: Minimum purchase: $100: In increments of: $100: Maximum purchase: $10 million (non-competitive bid) 35% of offering amount (competitive bid) (See Buying a Treasury marketable security for information on types of bids.) Auction frequency: Every four weeks for 52-week bills 3 Month Treasury Bill Rate - YCharts The 3 month treasury yield hovered near 0 from 2009-2015 as the Federal Reserve maintained its benchmark rates at 0 in the aftermath of the Great Recession. 3 Month Treasury Bill Rate is at 4.06%, compared to 4.06% the previous market day and 0.05% last year. This is lower than the long term average of 4.17%. Report. H.15 Selected Interest Rates.

Treasury Notes — TreasuryDirect Interest rate: The rate is fixed at auction. It doesn't change over the life of the note. It is never less than 0.125%. See Results of recent note auctions. Interest paid: Every six months until maturity: Minimum purchase: $100: In increments of: $100: Maximum purchase: $10 million (non-competitive bid) 35% of offering amount (competitive bid) TMUBMUSD01Y | U.S. 1 Year Treasury Bill Overview | MarketWatch Coupon Rate 0.000% Maturity Oct 5, 2023 Performance Change in Basis Points Yield Curve - US Recent News MarketWatch Treasury yields rack up biggest weekly declines in months as Fed's next... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

What are coupons in treasury bills/bonds? - Quora The "coupon" on a T-note or T-bond is the contractual rate as a percentage of par that will be paid to the holder one-half each time twice a year. A 6% treasury note due November 15, 20xx will pay the holder $30 per $1,000 face value of the note on May and November 15th of each year until the due date. Peter Elliott

Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Bill Rates. These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. View the Daily Treasury Bill Rates.

TMUBMUSD06M | U.S. 6 Month Treasury Bill Overview | MarketWatch Key Data Open 4.574% Day Range 4.571 - 4.584 52 Week Range 0.003 - 4.616 Price 4 13/32 Change 0/32 Change Percent -0.06% Coupon Rate 0.000% Maturity May 4, 2023 Performance Change in Basis...

6 Month Treasury Bill Rate - YCharts 6 Month Treasury Bill Rate is at 4.45%, compared to 4.46% the previous market day and 0.07% last year. This is lower than the long term average of 4.48%. Stats Related Indicators Treasury Yield Curve

What Are Treasury Bills (T-Bills) and How Do They Work? - Investopedia T-bills are short-term government debt instruments with maturities of one year or less, and they are sold at a discount without paying a coupon. T-Notes represent the medium-term maturities...

2 Year Treasury Rate - YCharts The 2 year treasury yield is included on the shorter end of the yield curve and is important when looking at the overall US economy. Historically, the 2 year treasury yield went as low as 0.16% in the low rate environment after the Great Recession. 2 Year Treasury Rate is at 4.49%, compared to 4.62% the previous market day and 0.45% last year.

What Are Treasury Bills (T-Bills), and Should You Invest ... - SmartAsset Let's say you purchase a $10,000 T-bill with a discount rate of 3% that matures after 52 weeks. That means you pay $9,700 for the T-bill upfront. Once the year is up, you get back your initial investment plus another $300. If you're interested in investing in T-bills, make sure you aren't looking at treasury bonds or treasury notes.

Should You Buy Treasuries? - Forbes The current rate on a U.S. two year Treasury is 3.05%.¹ In comparison, Nerdwallet reports the national average rate on a high-yield savings account is .70%. (Note: both figures are annualized,...

How To Read A T-Bill Quote - Investopedia Simply replace the asking price with the bid price in the equation. 3*100/360=$0.83 $10,000-$0.83=$9,999.17 In this example, the seller is willing to accept $9,999.17 for a bill that will be...

Treasury Bills Statistics - Monetary Authority of Singapore SGS T-bill Yield Curve. 6 12 Tenor (Months) 2.870 2.875 2.880 2.885 2.890 Yield (%) Latest Yield. Previous Week.

Treasury Coupon Issues | U.S. Department of the Treasury Daily Treasury Bill Rates. ... "The Yield Curve for Treasury Nominal Coupon Issues" by James A. Girola - 5/16/2014 "The Treasury Real Yield Curve and Breakeven Inflation" by James A. Girola - 7/21/2015 "Treasury Yield Curves and Discount Rates" by James A. Girola - 2/27/2016

Treasury Bills (T-Bills) - Meaning, Examples, Calculations - WallStreetMojo While the minimum purchase is just $100, up to $5 million non-competitive T-Bills can be purchased in a single auction. Competitive ones can be purchased up to 35% of the offering amount. According to US Treasury Department, the treasury bills rates on 3 rd September 2021 were as follows:

13-Week T-Bill Rate Cash (TBY00) - Barchart.com Today's 13-Week T-Bill Rate prices with latest 13-Week T-Bill Rate charts, news and 13-Week T-Bill Rate futures quotes.

US T-Bill Calculator | Good Calculators Treasury Bills are normally sold in groups of $1000 with a standard period of either 4 weeks, 13 weeks, or 26 weeks. Using our US T-Bill Calculator below you are able to select the face value of your bonds using the drop down list of common values, or you may enter an alternative value that isn't listed in the "Other Value" box.

![1. [20 points] You observe the following Treasury | Chegg.com](https://media.cheggcdn.com/media/e27/e270d5a8-78a8-4494-b4e5-34ea83f2212f/php46N91z.png)

Post a Comment for "44 t bill coupon rate"